Xavier Lazarus

July 2022

Despite everyone’s prediction, Covid for the majority of the tech/startup/VC industry was mostly a three week anxiety followed by the best 20 months ever. So, what’s happening now? Are we facing a longstanding crisis in our industry this time round? Is this a 2000 or a 2008 kind of crisis? How should startups and VCs adapt, beyond the series of emails sent by every investor about cost consciousness and the comeback of reasonable terms for future funding rounds? And will we see a summer after this winter, and when would that happen?

Facing this new market condition, I gathered thoughts and analysis from both discussions with key players on both sides of the Atlantic and based on my past experience in times of crisis. Having started when some of my colleagues were still in Kindergarten, 20 years ago and 3 crises ago, is one of the few privileges I have in the market!

In these five chapters – published weekly on our Medium account, you’ll find a compilation of data, insights and advice I’d like to share and discuss with you. This is by no means a sure-fire thesis nor an omniscient crystal ball, rather the strong desire to share data and provoke thoughts, so we can collectively weather the unfolding stormy conditions.

To make it easier for you to find, here are the links towards the five chapters below:

Chapter One

Chapter Two

Chapter Three

Chapter Four

Chapter Five

Chapter 1 : No doubt, a tech bubble inflated and then burst (but maybe not in 2022)

Officially, the Tech Bubble burst late 2021 in the US, even if the news spread only more recently in Europe. Note that I am not sure that the news has arrived at all early-stage investments yet, if I look at some deals which are still moving forward in the market.

This does look a lot like 2000 to me. There are however two major differences between then and now:

- The need for tech products and services is now well established and many of the most valuable publicly traded tech companies today are actual companies. In 2021, the US tech industry employed an estimated 5.8 million people (i.e. 4% of total US employment), according to the Computing Technology Industry Association;

- If you look carefully, the major difference with 2000 is in B2B rather than B2C because SaaS or Cloud didn’t exist back then so the inflated valuations of the software vendors in 2000 were not really justified by any major new growth trend.

Actually, the Nasdaq’s amazing performance during fall 2021, driven by the best assets’ dynamism and the buying spree of the “Tiger Globals” of the world, has shadowed the fact that deflating valuations in tech, might have started even earlier last year but were not immediately visible due to the indices being buoyed by the market cap dynamics of the GAFAM. Nevertheless, optimism was still the current doxa in private markets and the newborn category leaders were crafting the way to an everlasting growth of their valuations and underlying multiples until the peak on 18th of November 2021.

By the way, the Nasdaq is down roughly 30% since, but the cloud index is down 55%, showing that even the Nasdaq, doped by the large caps’ P&L quality, is perhaps not the best proxy for understanding the drama that has happened.

Is there a specific reason why the hot pre-Covid market for tech turned into a super bubble which burst with not that big a bang alongside a bigger and worse shock wave?

Some would argue that the increase of valuations was mostly linked to the fact that Covid put tech on the front scene whether for personal usage (I have since subscribed myself to at least six new different streaming services) or for digital transformation (when a CEO shuts down their offices and their business goes online & remote, do they have a choice but to increase their investment pace in digital transformation?). It surely did, leading to a strong and legit growth phase of revenues (and sometimes even profits) for the tech industry, driving up valuation multiples, leading to the massive inflation of valuations we saw. Small math interlude: if you double your short term revenues forecast and your Price to NTM revenues (revenue over the next twelve months), then sales multiple should at least double too because of the higher growth profile of your company, which results in your valuation being multiplied by more than 4!

This argument is partly true and makes me confident in the long run on what we do at Elaia: we back tech disruptors. Unfortunately, there is more to it and it is not as positive.

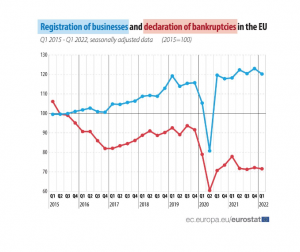

Digging deeper, what strikes me is that the main developed countries fired all their artillery during the pandemic to sustain the economy, sponsored by free ammunition from their Central banks. This helped sustain wages, consumption, corporate balance sheets, etc. above the waterline and independently of any economic rationale. As an example, the bankruptcy level in the EU was much lower in 2020 / early 2021 than its normal level when the economy is thriving (see below). Clearly, there was a bit of over-reaction, justified by a new kind of crisis for which the playbook had not been written yet.

This cash overflow ended, for a big part, in the P&L of the tech companies but it seems that a large chunk went also directly to the stock markets and speculative investments, a possible reason why being that maybe many subsidized businesses or people were not that much in need of strong support – especially in Europe.

Because of this surge of available capital in the tech markets, tech returns (part of them being real cash) were huge for founders, VCs, Angels, day traders, institutional investors etc. and even totally insane for the ones who timely played the Crypto or NFTs game.

When you make a lot of money, your “Who cares?” threshold goes up accordingly. The “Who cares?” threshold is a very simple concept: assume you are a well yet normally paid executive with no real financial pressure or issues to deal with, you might not chase coupons to save a few bucks when shopping for groceries. However, you might not impulsively acquire a $10k artwork when wandering in a fancy art district. Your “Who cares?” threshold lies between these two boundaries: it’s the level of cash below which you don’t mind having spent it, maybe unwisely, or paid too much, or having gambled and lost it. Imagine now that you are a March 2021 crypto zillionaire or a 25-year old unicorn founder who just raised a huge round with a good chunk of secondary. Your “Who cares?” threshold just went through the roof, and you can decide in the blink of an eye to put big money on a crazy seed round or a token issuance without caring for the downside. The same at even a larger scale would apply to any VC which multiplied its fund size by 5 to 10x and forgot that discipline is the name of its game.

These types of investors grew numerous and popular during the last two years and from my point of view, this is the main reason why demand for tech and crypto investments increased so rapidly (while the underlying web3 and decentralization movement is genuinely interesting, the crypto-craze of 2021 was insanely speculative). Valuations then followed, leading to overwhelming paper profits both in multiples and IRR, making funds and individual investors care less and less about prices since their “Who cares?” threshold moved up accordingly. The obvious positive flywheel effect associated with this excess of demand compared to the existing supply started to spin and voilà, the bubble expanded. This went even quicker and bigger because, at the same time, returns were not really appealing in most of the other asset classes.

Unfortunately, this kind of sequence always leads to an overheating of the system and then a burst. This is a known fact, with repeated proof points in history as cycles keep repeating and because humans are still humans after all. Here is the short and simplified version of what happened – please note that this is only an attempt to over-simplify the concept of economic cycles and bubbles:

- Step 1: A tsunami of new investors, looking for quick and easy money, floods the market while they should have never been investing in this market in the first place (the famous Taxi Driver tale of Warren Buffett).

- Step 2: Pressure on prices goes even higher and the market moves from sustained growth to uncontrolled rocketing.

- Step 3.1: Some of the “incumbent” investors started to take out some gains, while still shouting on reddit or twitter that the market was only at a starting point.

Note : greedy new investors in a speculative market can really be naïve: Crypto guys last year really looked like your friend, in a freezing lake, with blue lips and a shaking body, telling you that you should join them for a swim while the only thing they wanted is to get back on the sand and dry with your towel while you freeze in the water!

- Step 3.2: Many companies, including a lot of second tier ones, decide to benefit from the market conditions and thus increase the available supply of assets dramatically at an incomprehensible price (the 2021 IPO / NFT / coins stampede)

- Step 4: At the tipping point, supply completely surpasses demand and prices start to go south, first on the second tier assets and then on the entire market. Note that during the beginning of this phase, the market can still grow on average since there is still a lot of late money joining the party but these new investors fear that something might go wrong so they usually invest in more established assets and brands (the famous “final fly to quality”)

- Step 5: At some point, all numbers are between red and bloody red, so investors start to feel that their losses are for real, they understand that they are less rich than before, their “Who cares?” threshold reduces dramatically

- Step 6: Consequently, most investors stop investing or even try to liquidate their assets, and the few remaining ones who are open for business, strongly reduce the pace and size of any new investment. Prices go even lower, starting a negative vicious circle which replaces the previous positive flywheel one. An uncontrolled drop in the market happens; the bubble has burst!

This is mostly what has happened so far, very much like a 2000 kind of market correction, maybe quicker, but everything goes quicker now, right? The main question would be then, what makes the difference between a market correction and market explosion? Are we now just facing an excessive adjustment, in which case we should all start buying again sometime soon, or are we standing in front of a longer winter, and maybe even the start of a new ice age?

We shall discuss this in the following chapter: Adding a second layer of problems to the tech bubble burst.